Daily Comment – Demand for safe assets lingers

- Dollar, gold and US yields are on the rise

- US presidential election risks start to affect market sentiment

- Focus today on central bank speakers at the IMF annual meeting

- BRICS summit could generate headlines, particularly for the Middle East

US presidential election is firmly on the market's radar

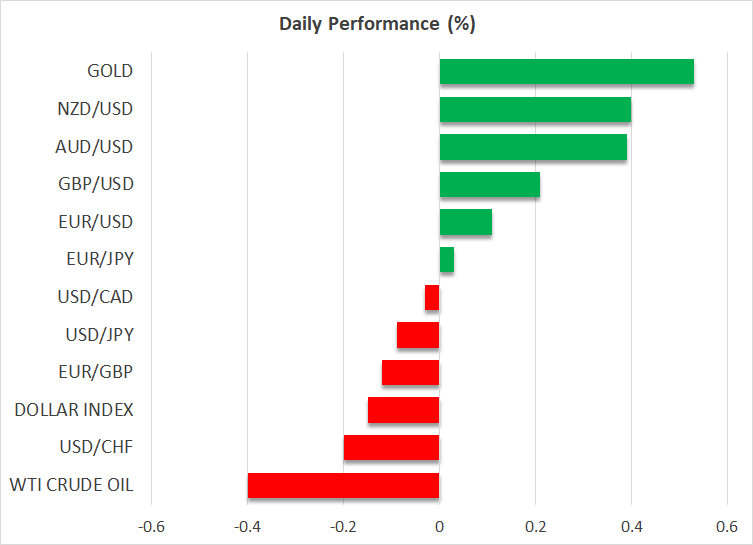

The US dollar continues to enjoy strong demand, outperforming its main counterparts. In particular, euro/dollar is trading at the lowest level since early August, and dollar/yen is hovering a tad below the 151 area. At the same time, gold is continuing its journey north, recording new all-time highs almost daily. Several reasons have been touted, with geopolitics, strong buying from Asian central banks and diversification away from the dollar being at the top of the list.

Euro/dollar is trading at the lowest level since early August, and dollar/yen is hovering a tad below the 151 area

In the meantime, the 10-year US Treasury yield has reached 4.2%, the highest yield since end-July, after climbing by more than 55bps from the mid-September trough. This move is counter-intuitive considering the fact that the Fed is preparing for another cut on November 7 and around 150bps of easing are currently priced in over the next 16 months.

Having said that, there is a common theme that could explain these movements. The US presidential election is acting as the rising tide that lifts all boats with investors seeking protection from a potentially negative market outcome. It is up to the market to decide if a Trump or a Harris win will produce a risk-off reaction, but market participants could also be preparing for a repeat of the 2000 presidential election, when the result was declared in courts almost one month after the election date.

Market participants could also be preparing for a repeat of the 2000 presidential election

Interestingly, stocks are also starting to feel the election pressure, with the S&P 500 index starting the week in the red and the Dow Jones index suffering the most during Monday’s session. Indicative of the current situation is the fact that the best performing stock in the Dow was Trump Media and Technology, potentially benefiting from the latest polls showing increased support for the former president.

Lighter calendar today, IMF and BRICS meetings under way

With most Fed speakers openly supporting the November rate cut, the focus today turns to the annual IMF meeting, which will take place in Washington, D.C. and will last until Saturday, October 26. A plethora of central bank members will be on the wires again today, mostly from the Fed, the ECB and the BoE, including ECB President Lagarde and BoE Governor Bailey.

A plethora of central bank members will be on the wires again today, mostly from the Fed, the ECB and the BoE.

Comments from BoE members will attract extra interest as the next BoE meeting, which will also feature the quarterly projections, is around the corner. The recent weaker CPI report has cemented the November rate cut despite the strong retail sales figures, with the market fully pricing a 25bps rate cut. However, the size of the rate cut could be affected by the Autumn budget published on October 30 with reports pointing to significant tax increases that will potentially dent the current momentum of the UK economy.

This week the 16th BRICS summit is also taking place in Russia. Five new members, including Iran and UAE, will officially join this bloc with Turkey, a NATO member, apparently considering membership. These summits do not tend to be market moving, but the world will pay extra attention to comments about the Middle East conflict and the rumoured announcement of a BRICS currency.

相关资产

最新新闻

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。